Americans are more stressed than ever about their finances. In a 2020 study by the National

Endowment for Financial Education, nine out of 10 Americans reported feeling anxious about

money. The stress levels were the same for people making less than $50,000 a year as they were for those making more than $100,000 annually.

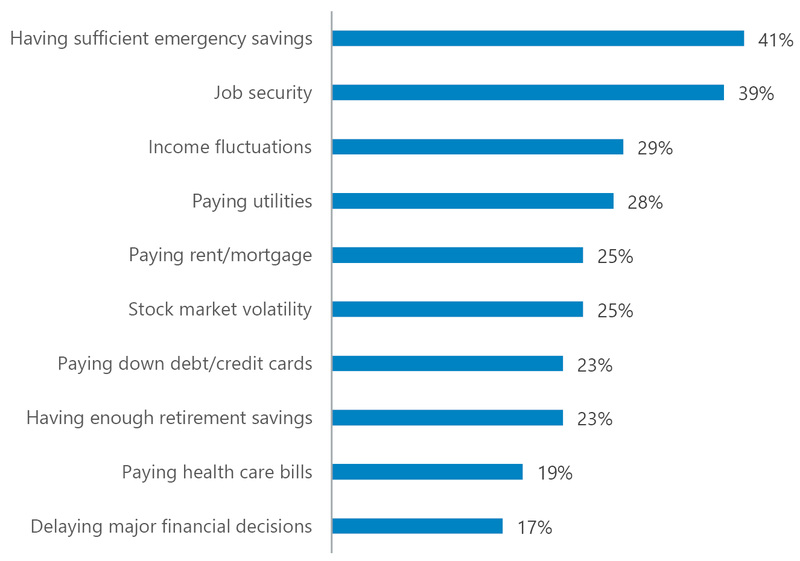

Top 10 Stressors Among American Adults

The top concerns focused on fundamentals: having enough money to survive a job loss and paying for necessities. Important, but farther down the list, were longer-term goals such as managing outstanding debt and saving for retirement. This worry about day to day has taken a physical toll on workers. According to a 2020 survey by Thriving Wallet, almost 35% of

workers say they are losing sleep due to financial stress, and another 21% say the anxiety has impacted their physical health.

Stress impacts work

In addition to the healthcare expenses associated with the effects of stress on workers’ physical well-being, employers have also begun to notice the impact on productivity. A 2019 study by John Hancock Retirement indicates that the distraction caused by personal finance challenges can significantly erode workers’ concentration. According to the study:

In addition to the healthcare expenses associated with the effects of stress on workers’ physical well-being, employers have also begun to notice the impact on productivity. A 2019 study by John Hancock Retirement indicates that the distraction caused by personal finance challenges can significantly erode workers’ concentration. According to the study:

55% of workers worry about finances weekly while at work.

Nearly half spend time on their finances while at work, with 19% spending at least three hours per month.

5% of workers missed a day or more of work in the last six months due to financial stress.

More employers are introducing financial wellness programs

To combat this problem, more and more employers are introducing financial wellness programs as part of their benefits communication strategy. Bank of America’s Workplace Benefits study reports that 62% of employers say they feel extremely responsible for their workers’ financial health, which is up from 13% in 2013. The Employee Benefit Research Institute (EBRI) says that 90% of employers currently have or are developing a financial wellness strategy. The EBRI study says 57% of these employers have constructed holistic financial wellness programs, compared to 18% of conduct periodic campaigns, and 17% who rolled out a one-time initiative. Focus topics for these efforts included:

Healthcare costs (40%)

Retirement preparedness (40%)

Financial-related stress (28%)

Budgeting and money management (28%)

Saving enough (25%)

Emergency savings (24%)

The ROI for financial wellness

Hancock’s study estimates the cost of lost productivity due to financial stress to be $1,900 per employee. Wellness provider Financial Finesse suggests that wellness programs can reduce that number considerably. In a study the company conducted on financial wellness program participants, it found that users of the program clocked 27% fewer absentee hours and their healthcare costs were $271.50 less.

Taking the first steps

Creating a holistic financial wellness program — one that considers multiple demographic groups and a complete roster of financial health topics — can be complex. According to EBRI, more than half of the employers who launched financial wellness programs did so with the help of a consultant. Whether working independently or with an advisor, there are several key steps to take when assembling a financial well-being strategy:

Conduct a behavioral analysis to understand how employees currently use, do not use or misuse wealth building or protecting benefits including retirement plans, health savings accounts, deferred compensation plans, and life and disability insurance benefits. In the study, look for both broad themes and issues specific to particular demographic or other groups.

Inventory products, tools, services and programs available from all wealth benefit and protecting providers, both to establish specific calls to action for employees and to maximize dollars you are already spending with these vendors.

Review media trends, emails, intranet traffic, management meetings, posters, etc., to identify channels most used by employees. Effective programs place messages where workers are most likely to see them.

Consider creating incentives and deadlines to encourage employees to act.

If culturally appropriate, survey employees to better understand their issues outside of the workplace, including debt, child care and personal insurance coverage, as a way to further inform program development.

The Lockton team can help

Lockton advisors have experience conducting analyses, working with financial wellness providers, and building financial well-being educational programs. If you’re thinking of creating a financial health program or are reevaluating a program currently in place, your Lockton service team can help. If you are not yet a Lockton client, please contact us at retirement@lockton.com (opens a new window).

Download Paper (opens a new window)

Download Paper (opens a new window)