From simple coverage reviews to fully-embedded risk management services, discover the many ways Lockton can help with your insurance needs across Europe

1 / 5

Sign up to our Europe Insight Newsletter

Stay informed about emerging risks and how to address them with our latest thought leadership content.

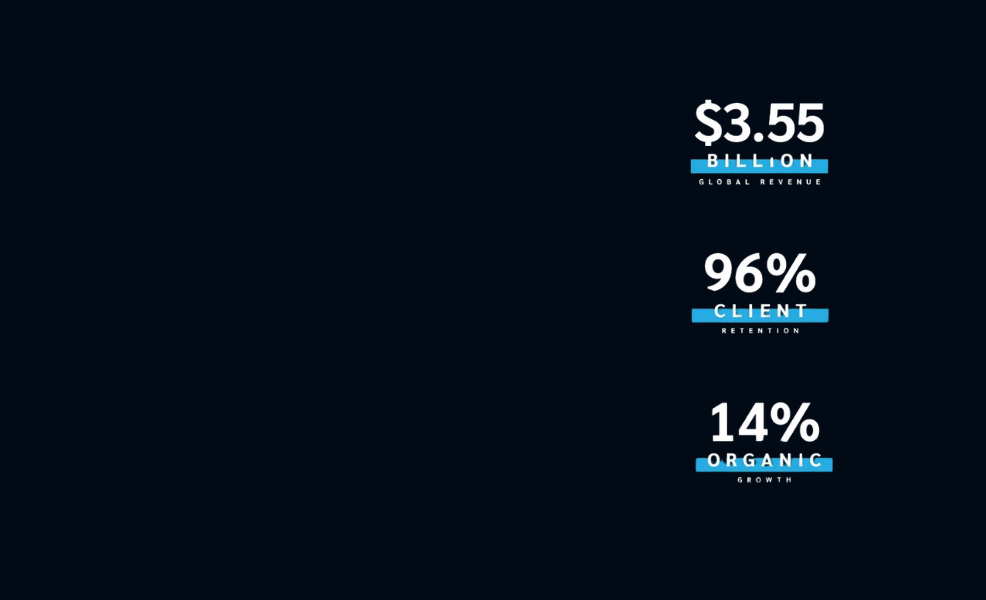

Register nowUncommonly Independent

We bring creative thinking and an entrepreneurial spirit to the insurance business and are uniquely positioned to help you succeed.

See our storyLatest news and insights

Law firms: should you purchase a wills bank?

articleA wills bank is a centralised storage system for original wills and estate planning documents, often used by law firms to manage and safeguard clients' testamentary documents. Purchasing a wills bank can provide law firms with long-term client retention and bu ...

We're here to help

We bring creative thinking and an entrepreneurial spirit to the insurance business and are uniquely positioned to help you succeed.

Get in touchWith a global footprint of 135+ offices, there’s sure to be one near you.

Find an office*135+ Lockton offices and partner offices worldwide