The IRS has announced (opens a new window) the inflation-adjusted contribution and related amounts for health savings accounts (HSAs) and HSA-compatible high-deductible health plans (HDHP) for 2026.

This Alert outlines the 2026 HSA limits and offers additional information on limits imposed by the Affordable Care Act (ACA).

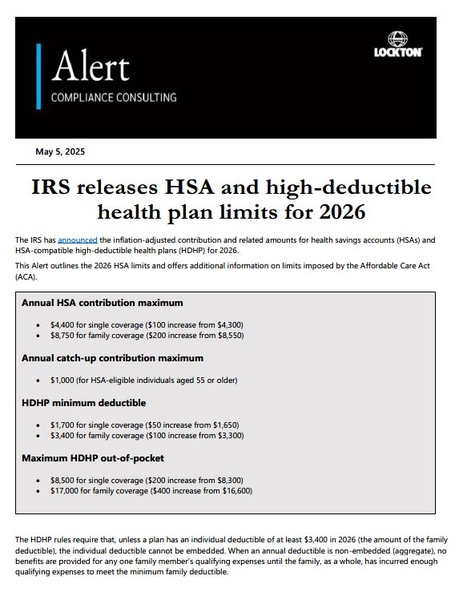

Annual HSA contribution maximum

$4,400 for single coverage ($100 increase from $4,300)

$8,750 for family coverage ($200 increase from $8,550)

Annual catch-up contribution maximum

$1,000 (for HSA-eligible individuals aged 55 or older)

HDHP minimum deductible

$1,700 for single coverage ($50 increase from $1,650)

$3,400 for family coverage ($100 increase from $3,300)

Maximum HDHP out-of-pocket

$8,500 for single coverage ($200 increase from $8,300)

$17,000 for family coverage ($400 increase from $16,600)

The HDHP rules require that, unless a plan has an individual deductible of at least $3,400 in 2026 (the amount of the family deductible), the individual deductible cannot be embedded. When an annual deductible is non-embedded (aggregate), no benefits are provided for any one family member’s qualifying expenses until the family, as a whole, has incurred enough qualifying expenses to meet the minimum family deductible.

In addition, HDHPs have a different annual out-of-pocket (OOP) limit than the annual limit under the ACA. For 2026, the ACA OOP limit is $10,150 for single coverage and $20,300 for family coverage. HDHPs must use the lower of the OOP limits (ACA limit vs. HDHP limit).

Non-calendar year HDHPs will adopt the 2026 deductible and OOP limits with the start of their new plan year. For example, a HDHP with a July 1 plan year, will be subject to the $1,700/$3,400 deductible and $8,500/$17,000 OOP limit on July 1, 2026, which continues through June 30, 2027. However, the HSA contribution limits apply to the calendar year even for non-calendar year plans.

Not legal advice: Nothing in this alert should be construed as legal advice. Lockton may not be considered your legal counsel, and communications with Lockton's Compliance Consulting group are not privileged under the attorney-client privilege.