When massive changes arrive, they seem to manifest in every aspect of our personal and professional lives. As we grapple with a new era of data — with more information available from more sources than ever before — risk professionals are being challenged to use that data to help keep organizations on track.

But it’s not a simple task. In fact, it requires fresh ideas and innovative strategies.

Here’s how risk professionals can leverage data and analytics more effectively to meet the evolving expectations of C-suite executives and to deliver the answers to their increasingly difficult questions.

New demands, new data

Facing a truly dynamic environment, risk management teams are under immense pressure. Global finance, energy, and supply chains are more interconnected than ever before, enabling losses to materialize more rapidly and with greater intensity. At the same time, shifting economic conditions — marked by high inflation, rising interest rates, and volatile equity markets — have made capital more costly, stressing corporate balance sheets.

Some of these pressures have eased over time and could continue to moderate in the months ahead. C-suite executives, nevertheless, are asking tough questions. And their expectations of risk management teams are changing: A sophisticated approach to data and analytics to support strategy, risk-taking and decision-making is no longer something that’s nice to have — it’s now table stakes.

Given this, it might seem serendipitous that more information is readily available to us today than ever. Every minute, according to data and analytics firm Domo, the average person produces 102 megabytes of data (opens a new window). That adds up to a staggering 53.6 terabytes of data per person per year.

Insurance buyers that can capture, organize, and integrate this data into decision-making can unlock powerful insights, improve efficiencies, and gain competitive advantages. And risk professionals who can master data and speak C-suite executives’ language can help their organizations pivot from seeing insurance as an expense to one that recognizes it as a valuable form of capital.

But wading through this data to distinguish between what’s relevant and what’s noise — and asking the right questions — requires a thoughtful approach. And it requires working with the right advisor.

Back to basics

For any analysis, data integrity represents a significant challenge.

Insurance brokers and insurers collect information from a variety of sources, including loss runs, exposure schedules, and external databases. Unfortunately, this data often lacks uniformity due to varying valuation dates, manual adjustments, and keying errors.

Similarly, changes in business operations — including mergers, acquisitions, divestitures, and discontinued products and/or services — can significantly impact data quality or reduce the relevance of certain data for analyzing current or future risk factors. A staggering 89% of CFOs regularly make decisions based on data they know is inaccurate (opens a new window), according to a recent survey by consulting firm Pigment.

An effective broker must navigate this complexity by looking beyond the numbers, developing a complete understanding of an organization’s business operations and ensuring data quality and consistency. Brokers and the organizations they advise must also work together to ensure they are asking the right questions — not just the most obvious ones.

Unfortunately, in the rush to get things done, this step is often overlooked.

Garbage in, garbage out

In most endeavors, one will find that your results are only as good as your input. That’s especially valid, however, in the world of P&C analytics.

Working under tight timeframes and with limited staff, risk professionals are often asked to harness data from multiple sources and use it to develop relevant and cost-effective strategies. This leaves little, if any, time to vet data or validate assumptions around future changes to risk profile. If left unchallenged by brokers or insurers these assumptions can impact the quality and confidence of decisions made during renewal, with profound effects on everything from retentions to attachments to limits.

A recent example can be seen in the industry push for up-to-date values for insured properties. During the soft property market cycle from 2012 to 2018 companies were able to consistently roll forward schedules of value (SOV) “as is” or with minimal inflationary adjustments. To stay competitive, insurers could easily downplay supply chain constraints and the impact of “demand surge” pricing adjustments. As a result, combined ratios soared as premiums fell short of true exposures and rising loss costs.

As the property market started to harden in 2018, insurers sought to rectify this issue but struggled with how to accurately determine correct values. Significant adjustments were made initially, but year-over-year adjustments have since stabilized — and the entire process still lacks credibility and certainty. This poses ongoing challenges for insurers — and policyholders — seeking to understand their aggregate exposure to loss. How can companies account for unknown trends in prospective analyses?

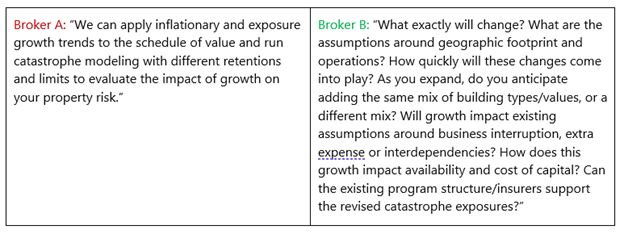

Question: Our company is planning for significant growth over the next five years. What will this mean for our property insurance program?

Going deeper

Although most analyses begin with a question (or two), risk professionals must be careful to ask the right ones.

This isn’t always as straightforward as it may seem, and advanced techniques are often required to gain clarity. Do the questions simply frame the desired outcome or are they focused on understanding the actual challenge? Is there consensus across the organization? Does the data needed even exist? Defining the problem statement and developing clear, concise questions are critical to using data and analytics effectively. This can take additional time on the front end but pay enormous dividends down the road.

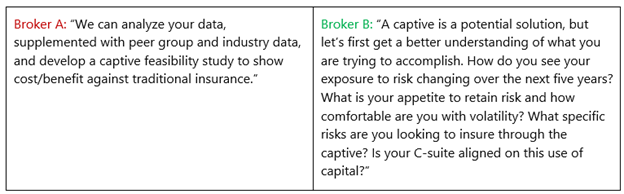

Question: Is a captive right for me?

Bringing the right stakeholders to the table

Involving all relevant parties is critically important to the short-term efficacy and long-term applicability of any analysis. Each business segment in an organization has its own goals, objectives, and views around materiality. It is critical to identify all relevant stakeholders and seek input to focus the analysis and ensure the right questions are being answered.

This approach can elevate the risk management department within an organization by ensuring buy-in and support for any decisions made. It can also help the C-suite better evaluate various alternatives as senior executives look to optimize use of capital.

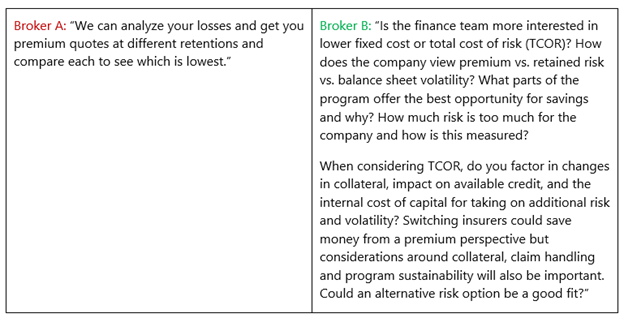

Question: We need to reduce costs. What retentions should we consider?

Multiple paths to action

Before interpreting any analytic results, it’s important to remember that every model is based on an unknown set of future events, and every estimate carries a range of uncertainty.

The degree of acceptable variability within this range should be part of any planning discussion. Organizations should use such discussions to understand potential variables that could produce results at the lower or higher end of the range.

Another consideration involves the nuances of each model being used. In the same way that two people can respond to the same question differently, two models using the same data can provide very different insights. An analysis will not be valuable or reliable without a clear understanding of the underlying assumptions, nuances, and limitations associated with each model. Understanding how the broader markets view a model can also be helpful.

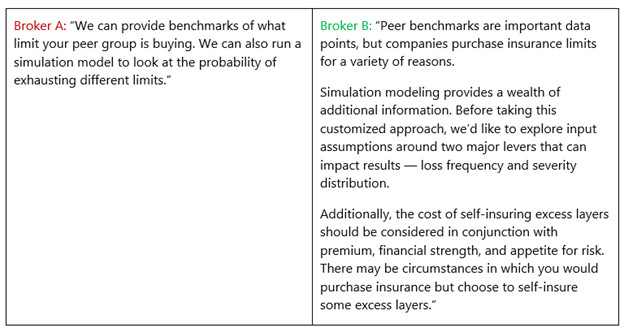

Question: What is the right limit to buy?

Do you have the right advisor?

The sheer volume of information available and compressed timeframes can sometimes seem overwhelming. The best organizations, however, recognize that the proper use of data and analytics is a process. They clean the data, challenge historical assumptions, and break down silos. They are curious, open-minded and inquisitive. The risk professionals for these companies are viewed as strategic partners.

Virtually every broker will highlight its analytic platform and emphasize the use of data, technology, and advanced coding techniques. But when it comes to using analytics effectively, far more is needed. Critical insights and competitive advantage turn on understanding data, clarifying assumptions, and asking the right questions. This can only be achieved through collaboration between client and broker, and being vulnerable enough to move beyond comfort zones and challenge the status quo.

At Lockton, our brokers and analytics teams work in lockstep to understand the nuances and details of your business, help you ask effective questions to identify root problems, and clearly communicate findings. Our analytic teams are local and built into our service teams. Analytics aren’t a profit center, which results in you getting exactly what you need when you need it. This results in more confidence around the decisions you make, whether you choose to buy insurance or not.