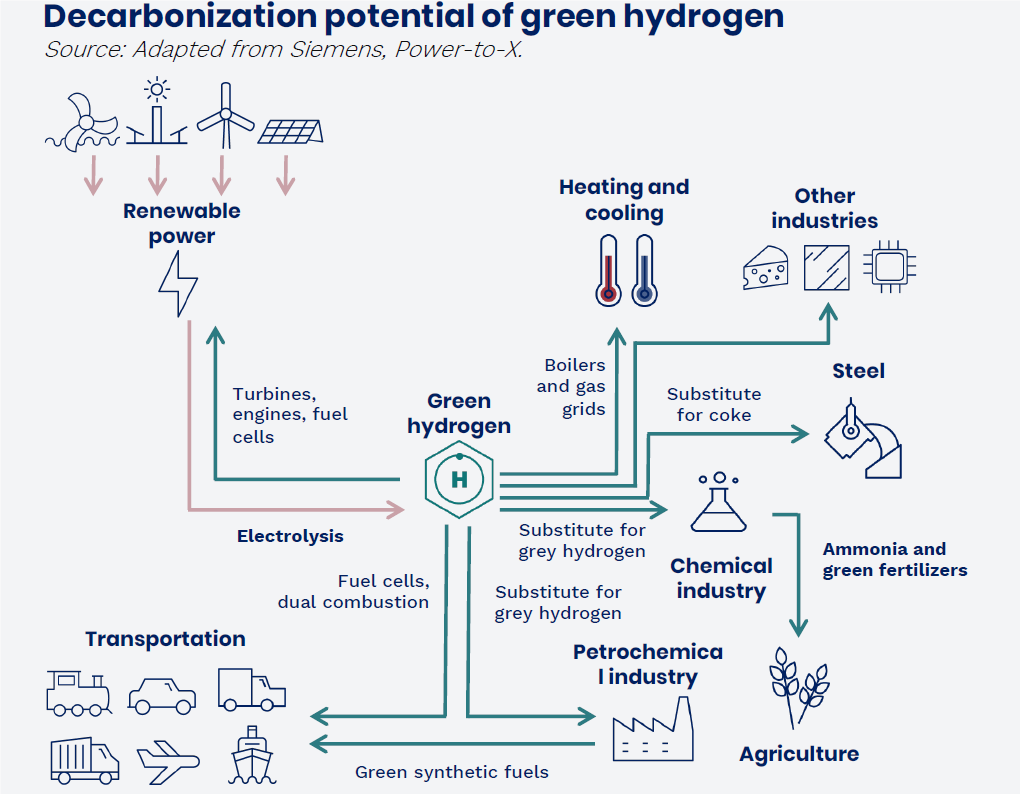

Hydrogen is one of Planet Earth’s most common substances and over the last few years in pursuit of countries putting in place ambitious greenhouse gas emissions reduction targets, hydrogen has played an increasing part in their plans and perhaps gained some traction from the COP26 gathering in Scotland. Whilst extremely common the challenge has been to safely and economically, produce it; transport it; store it; and utilise it. However, as with all large and innovative projects, potential risks need to be closely monitored and addressed, not least to get the necessary support from financiers and insurers to grow the use of this highly inflammable gas in order to assist in reducing greenhouse emissions.

Several countries in the MENA region offer near perfect environments for solar energy production and thus for 'Green Hydrogen’ production, whilst a smaller number in the region have environments suitable for wind energy production. Several countries, notably Egypt and Jordan were early movers in passing legislation necessary to encourage investment in both of these sustainable renewable energies with other countries in the region currently moving into overdrive including using the renewable energy to produce hydrogen and ancillary products.

One of the problems with electricity generation is that until recently it cannot easily or economically be stored for when it is most required to meet the demand for it. When we hit our light switches we expect the lights to immediately turn on no matter what the time of night or day, whether the sun is shining or the wind is blowing, or not. This is known as the demand side of the equation. Thus one issue with Renewable Energy which is often also referred to as Green energy, is that some of the green energy production cannot be consumed immediately so it needs to be stored and distributed where and when it’s required. Using current technology batteries on a large scale would be too expensive but I suggest that we ‘watch this space’

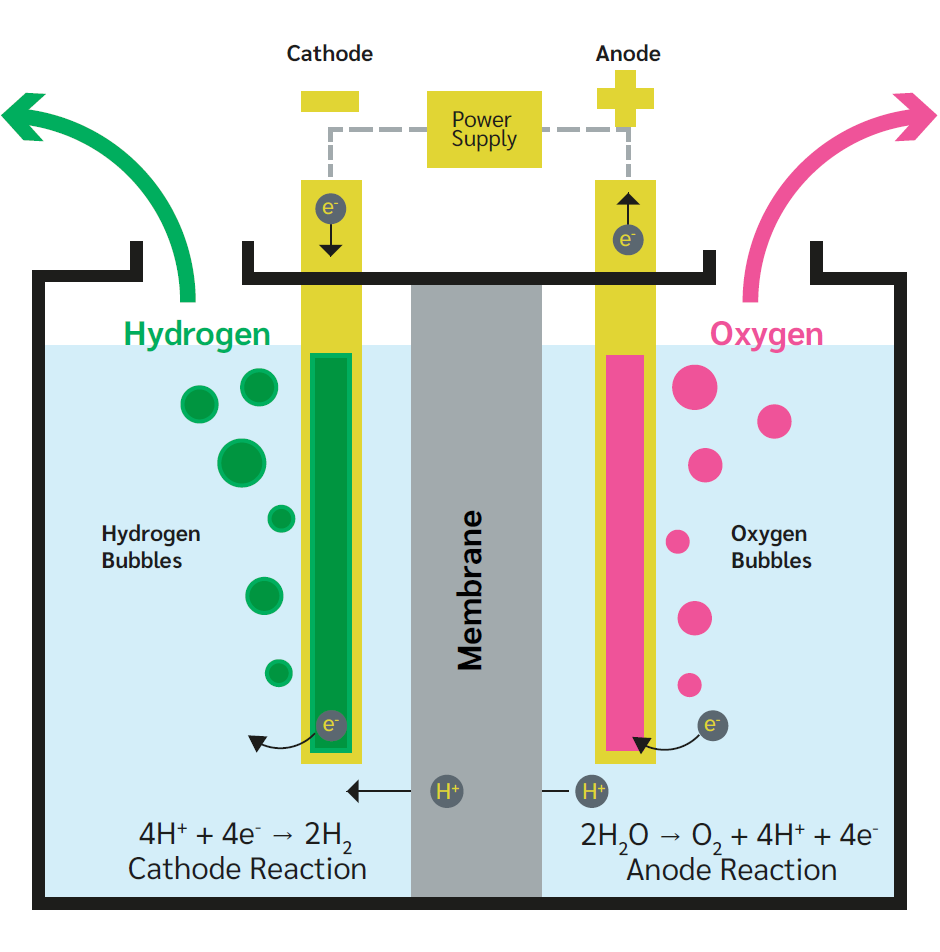

Electrolysers which are currently the most common method used to produce hydrogen, can be expected to be able to operate with a relatively wide technical envelope, operating and

storing at capacity whilst renewable energy is plentiful and any surplus electrical energy is economically available to be stored for future use. This flexibility to generate then store until

needed, will have a positive impact upon maximum operational demand and ‘load shifting’ in the country according to comments from the Australian Energy Market Operator.

Using renewable electrical energy to generate hydrogen, which can then be transported and stored until it’s required to generate electricity again, creates further flexibility. Hydrogen can serve as an energy carrier and ‘warehouse’ that emits no greenhouse gases whenever and wherever it’s eventually used.

Hydrogen can power different forms of transport either within fuel cells, or by burning in a combustion engine similarly to petrol or diesel fuels. Hydrogen can also be used in the same way as natural gas in adapted power plants to generate electricity. It has also been mooted that as part of the decarbonisation effort, coal fired power plants which already have existing necessary supporting infrastructure may be re-commissioned to operate on hydrogen.

Hydrogen production

Electrolysis of water is emerging as an economically workable process to produce hydrogen

using electric current generated from renewable sources. The energy enables the separation of water into its constituents, hydrogen and oxygen.

Source: Hydrogen Energy Overview by Richard Clark, Lockton

Among the challenges to produce green hydrogen is that the process requires water. Distilled

water is unsuitable as it lacks dissolved electrolytes. While seawater would be the preferred option due to its abundancy, the disadvantages of this option include corrosion loss and the need for expensive noble metals as catalysts. An alkaline solution (pH greater than 7) is therefore currently the most economically viable option to perform the electrolysis.

Another challenge is to store and transport hydrogen efficiently and safely. In the form of gas, hydrogen is not very dense and therefore requires more space than for example when in liquid form. In addition, leaks in the containing medium could lead to vapour cloud explosions. The primary method for storing hydrogen for use in cars, buses and other forms

of transport is within pressured fuel tanks. An efficient way of distribution would be to adapt the infrastructure already in place such as is used for natural gas. Alternatively, hydrogen can be transported over long distances by sea, by adapted ships or barges. Hydrogen gas can also be converted to ammonia, which has already established uses in for example, the farming and cultivation industries and although adding costs to the equation, can also be used as a safe and effective transportation and storage medium.

Naturally occurring underground caverns that have been drilled into for the natural gas or oil they once contained, or other man-made caverns, created via a leaching process in rock salt can serve as storage facilities for large amounts of the gas.

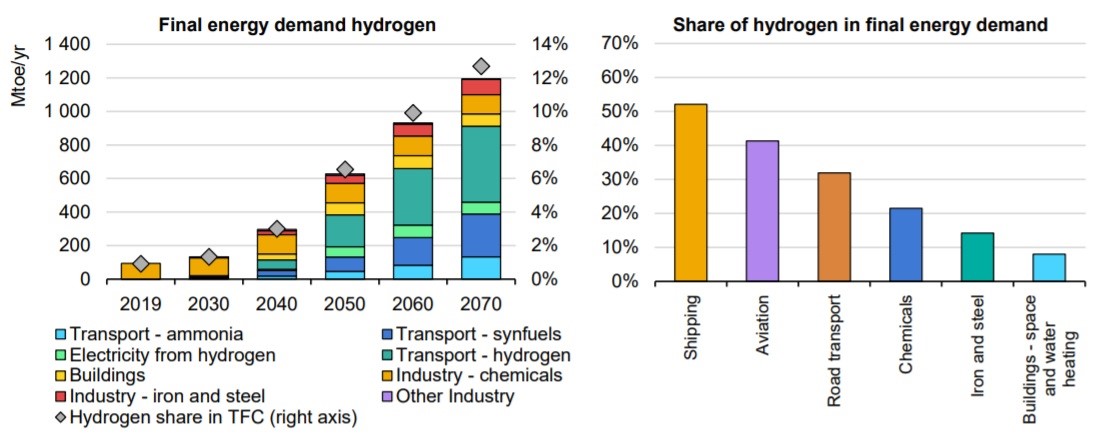

Global final energy demand for hydrogen in a sustainable development scenario

Source: IEA Energy Technology Perspectives 2020

Potential risk drivers

While the producing and handling of hydrogen has been extensively tested in the past in many areas, the type and scale of projects that the hydrogen initiatives entail are unprecedented.

Supply and value chains for the hydrogen strategies are complex and will require precise coordination, particularly as new companies enter the market as planners, manufacturers, storage operators and end users. There is a definite learning curve for all companies involved

including insurers, which are crucial to ensure the viability of such commercial ventures and whose capital sits contingent to project financiers and which is needed to encourage the development of projects and technologies. All projects require careful risk assessment and regular information exchange with insurers in order for them to understand the risks which they are being asked to assume whilst a sustainable insurance market participation will be

instrumental in developing a successful hydrogen industry which can contribute meaningfully to the Zero Carbon targets.

Areas of concern

Allianz Global Corporate & Specialty (AGCS) has recently identified a number of key areas of concern in a recent risk bulletin (opens a new window):

Green hydrogen requires large electrolysers to power electrolysis plants that are not yet widely available.

Hydrogen is difficult to store given the large volume required.

Hydrogen is difficult to transport and is prone to making steel pipes and welds brittle.

The gas is highly flammable and can escape through miniscule leaks if not stored properly, potentially causing an explosion if it mixes with air. Leaks are hard to identify without dedicated detectors since hydrogen is colourless and odourless. A hydrogen flame is almost invisible in daylight.

Hydrogen can potentially damage the stratosphere if released into the environment, contributing to the build-up of greenhouse gases.

Damage to the electrolysis cell can result in significant losses and claims due to extensive interruption of production.

Membranes (polymer electrolyte membrane electrolysis) are sensitive to impurities, which can challenge reliable long-time operation.

Lead time for new membranes could be long (several months), resulting in production delays.

Short circuits due to corrosion on the electrodes could cause an oxygen-hydrogen-gas explosion.

Local overload can damage diaphragms.

Cathodes/electrodes also represent a possible source of damage (again leading to potential long production delays).

Diffusion of hydrogen can cause metal and steel to become brittle which can affect a wide range of components, for example, piping, containers or machinery components. In conjunction with embrittlement, hydrogen-assisted cracking (HAC) can occur.

Converting existing natural gas pipelines to hydrogen requires detailed investigation.

The main risk in liquefaction plants is the handling of the explosive hydrogen, which requires sufficient protective measures. Further, a high risk of business interruption costs may ensue in case of failure of individual components.

Larger equipment, such as heat exchangers, are unique and therefore critical with respect to business interruption.

The risk of pipeline transport of hydrogen and the associated infrastructure, such as compressor stations, needs to be assessed individually, addressing not only the use of suitable materials to avoid embrittlement, but also the increased flammable range of hydrogen/air mixtures compared to natural gas.

Careful occupational health and safety measures are necessary not least because of the flammability of hydrogen/air mixtures.

An AGCS analysis of more than 470,000 claims across all industry sectors over five years shows that fire and explosions caused considerable damage and destroyed values of more than €14bn ($16.75bn) over the period under review.

Excluding natural disasters, more than half (11) of the 20 largest insurance losses analysed were due to this cause, making it the number one cause of loss for businesses worldwide. Business interruption (BI) costs following a fire can significantly add to the final loss total. For example, AGCS analysis shows that across all industry sectors, the average BI loss from a fire incident is around 45% higher than the average direct property loss – and in many cases the BI share of the overall claim is much higher, especially in volatile segments such as oil and gas.

In general, insurers are feeling their way with the different risk aspects of hydrogen. Insurance terms, conditions and prices are based on historical data for which little yet exists for hydrogen risks. The insurance market is constantly dynamic and evolving and insurers will respond by putting their capital at risk for what they consider to be the ‘right price’ based upon the specific characteristics of the risk presented to them. As always, a responsible risk

management programme will be well received in those markets.

Recommendations:

Secondary explosion protection can ensure safe design of electrical and other installations in rooms where the formation of a mixture cannot be completely excluded.

Ignition sources should be avoided where possible for example by using alternatives to electrical components. Proper earthing of all relevant parts and conductive floors should also be considered.

Tertiary explosion protection adds another safety layer. It includes designing and constructing buildings and facilities to withstand an explosion with limited damage.

Carefully maintaining the facilities and machines according to the manufacturer’s recommendations is crucial. This should include a combination of predictive maintenance measures and periodic maintenance procedures.

Risk management processes:

Identify hazards and define risk mitigation measures.

Ensure the integrity of the system.

Ensure proper ventilation to prevent accumulation (manage discharges).

Ensure that leaks are detected and isolated.

Ensure adequate training of staff.

AGCS is one of the largest insurers and reinsurers in the world with offices and risks located around the globe. They are an acknowledged industry leader and other potential hydrogen insurers whose capacity will be needed in order to fill insurance orders for some of the largest projects will share similar concerns.

The insurance view

Insurers will need to develop a more detailed underwriting approach to this segment and apply the same rigor in risk selection and underwriting as they do on existing energy construction and operational business. (opens a new window)

AGCS data shows (opens a new window) that many hydrogen fires result from the self-ignition of sudden hydrogen release through rupture of disks and pressure relief valves. About 25% of the losses were attributed to leaks. Of these leaks, 40% were undetected before the loss. Contributing factors were inadequate ventilation and inadequate purging.

The data also shows the advantage of locating hydrogen equipment outdoors. Hydrogen has been accidentally released outdoors many times without ignition. Almost all indoor releases have ignited. Indoor releases resulted in more than three times as many explosions than fires, whereas outdoor releases have resulted in an approximately equal number of fires and explosions.

While fire and explosion are key perils, as with any energy risk, business interruption and liability exposures are also important. Transit and installation issues and mechanical failure exposures are also present.

Insurance solutions for the hydrogen power supply is likely to involve tailoring existing risk transfer and mitigation product capabilities for this new segment. This may result in cross-class solutions – for example, joining marine, liability and energy and construction coverages for smaller hydrogen facilities, if there is demand for a cross-product offering.

Lockton MENA have several clients operating across the region and in Africa and Asia and through our global network of offices around the globe which are working in the Hydrogen space in various roles. We believe that for all our clients a key to securing adequate and competitively priced insurance capacity for whatever risks they seek to transfer is: information, information, information. And this is more so with the evolving hydrogen industry. An open and ongoing dialogue with potential insurers, which can lend their experience on projects around the globe is essential.

Small hydrogen

We have discussed large or utility scale hydrogen so far in this paper but it would be remiss not to comment on retail use and risk exposures and possible insurer concerns.

Whilst EVs or electric vehicles have received much publicity over the last few years there are now growing fleets of hydrogen fuelled private cars and commercial vehicles in many countries. Hydrogen is being used as a substitute for petrol in Internal Combustion Engines with its only ‘exhaust’ being water with numerous experiments proving that the water is pure enough to drink. Insurers will be monitoring both the performance and the repair cost of hydrogen powered vehicles with great interest. Will hydrogen cars attract more young and

inexperienced drivers who statistically are shown to be more prone to driving accidents? Will fires or explosions be more prevalent in such vehicles following collision when compared to similar petrol or diesel or electricity driven vehicles?

In coming years hydrogen, which comes in a rainbow of colours dependent upon its manufacturing process and how environmentally friendly that process is, is also slated to replace natural gas in providing heating and cooling for domestic and commercial premises. Leakage, fire and explosion data will be closely watched by insurers notwithstanding that they and the regulatory and installation authorities will set rigorous standards of design and installation before green lighting such changes.

We have deliberately not mentioned the ‘rainbow’ of colours attributed to other manufacturing sources of hydrogen but perhaps those can be the subject of a future paper.

The authors of this article have extensive experience in developing Risk Management and Risk Transfer solutions for many forms of Renewable Energy projects whether balance sheet or Limited Recourse financed and welcome comments on this article and enquiries from Developers and/or Financiers. Technical comments from OEMs would also be valued.