As governments increase their investments in renewable energy, demand is rising for energy storage systems capable of bridging the supply gaps created by unpredictable weather patterns. ‘Flow’ batteries, a form of long-duration battery, are likely to be part of the solution. However, to make sure insurers are comfortable underwriting the risk that such batteries present, it’s vital to involve them as early as possible within the development process.

Understanding the gaps in renewable energy supply

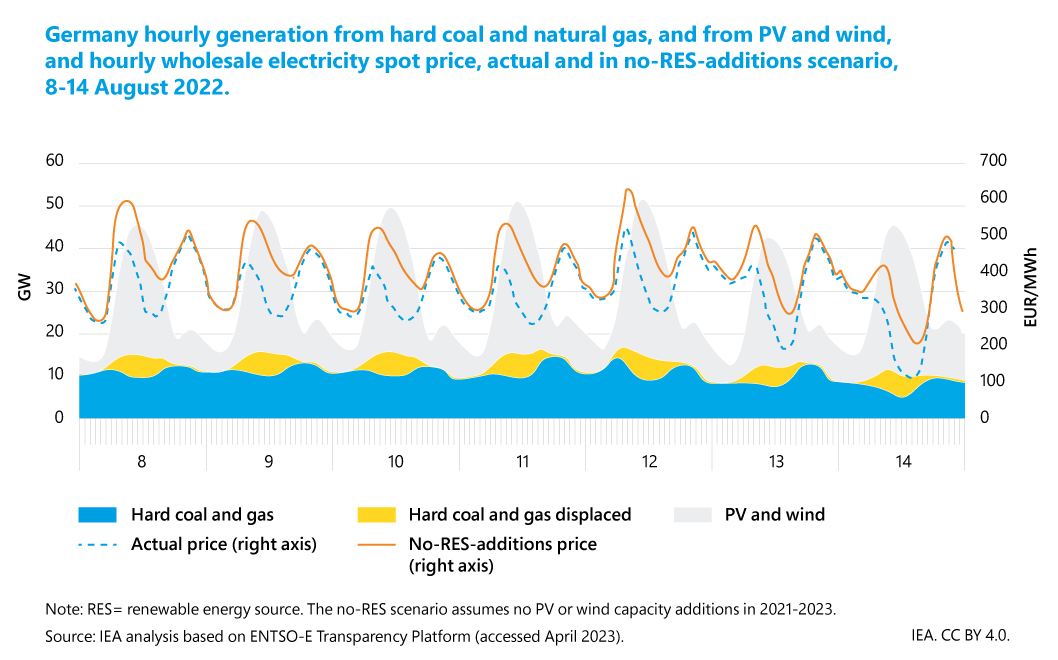

Currently, dispatchable energy generation such as from coal, oil, gas or nuclear, supplies the base level of energy in most countries across the world (see Germany example below). Renewable energy such as from wind or solar power is added to the mix as it’s being generated.

Source: International Energy Agency (opens a new window)

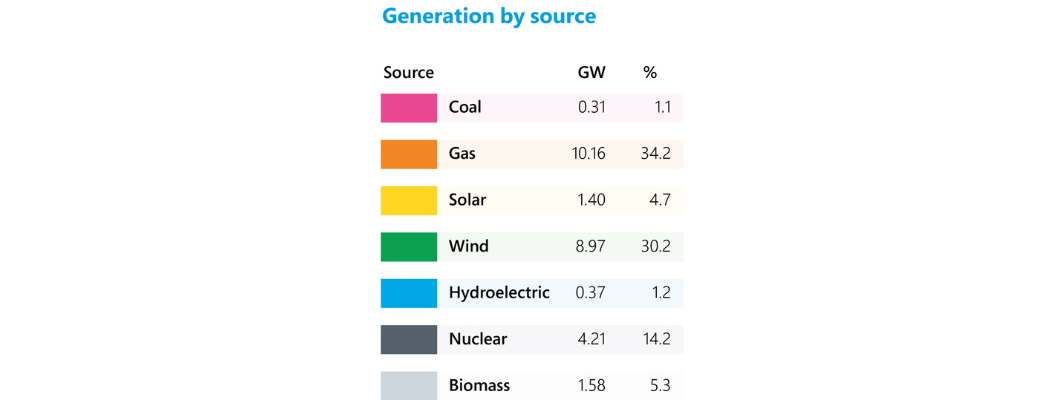

In the UK, renewable energy already makes up a relatively high proportion of the energy mix, with wind power supplying 30% of the energy consumed over a 12-month period.

Source: National Grid (opens a new window), October 2023

Only 1.4% of the energy is stored in the form of pumped storage in the UK. To bridge the gaps between supply and demand, the UK relies on neighbouring countries with 6.4% of energy sourced from so-called interconnectors. But this can come at a cost. During a heatwave in July 2022, the UK was forced to pay (opens a new window) record energy prices to avoid a blackout. It needed Belgium to crank up ageing electricity plants to send energy across the English Channel.

The case for energy storage

Energy companies that can store electricity are able to profit from price differences created by disparities in supply and demand. To be able to buy energy when the price is low and to sell it when the price is high, energy traders need storage capabilities.

Currently, lithium-ion batteries are the most popular option for Battery Energy Storage Systems because they offer fast, short-duration, high energy density and discharge power – features that make them well-suited to meeting the needs of the current energy market. On an average day, the market experiences two price/demand peaks when supply struggles to meet quickly rising demand. To prevent declines in system stability, grid frequency must be maintained at around 60 hertz (in the case of the US) or 50 hertz (in the UK and Europe), typically for a duration of one hour or less. Currently, this is one of the primary applications for energy storage.

But market patterns are set to change. The transition to net zero will be based on efforts to increase energy efficiency on the one hand, and an expansion of renewable energy generation on the other. According to the International Renewable Energy Agency (IRENA)'s Roadmap to 2050 (opens a new window), renewables could make up 60% or more of many countries’ total final energy consumption by 2050 if deployment is accelerated, compared to just 15% in 2015.

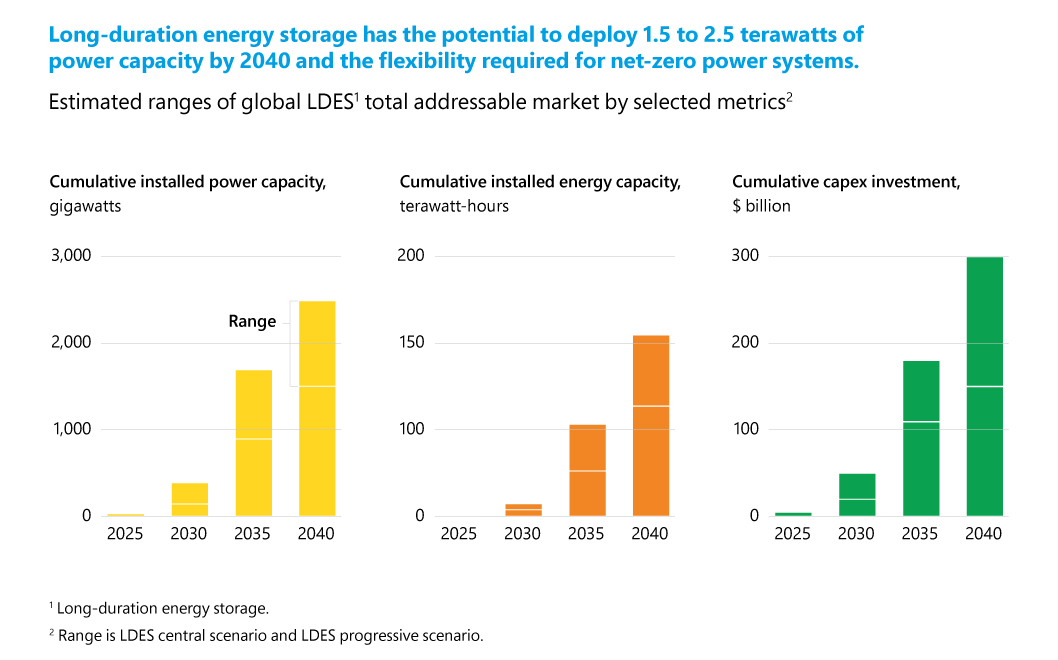

With a higher share of renewable energy in the mix, more energy storage capacity will be needed to bridge longer supply gaps when weather patterns are unfavourable. In this scenario, lithium-ion batteries will no longer be suitable. In the future, focus is likely to shift towards the development of alternative storage technologies such as flow batteries, which offer a longer duration of energy supply output.

Source: Tamarindo/McKinsey (opens a new window)

Flow batteries vs traditional lithium-ion

Lithium-ion batteries | Flow batteries |

Enables fast, strong bursts of energy. Discharge can usually last up to two hours at a time. | Relatively low charge and discharge rates. Can discharge for up to 10 hours at a time. |

High-density and require little space. Lithium-ion batteries are lighter and more portable than flow batteries. | Flow battery systems have smaller power density than lithium-ion batteries. They are heavy and require sizable electrolyte storage tanks, making them suitable for large-scale applications. |

Produces heat and ventilation systems are almost always required for utility-scale Li-ion systems. | Some flow batteries such as iron flow batteries can operate in ambient conditions from –10C to 60C (14F to 140F) without the need for heating or air conditioning. |

Lithium is a toxic chemical and may cause pollution. | Some flow batteries include corrosive or toxic fluids, but iron flow batteries tend to utilize a non-toxic, non-hazardous, and completely recyclable iron-based electrolyte. |

Lithium batteries contain flammable electrolytes and have a relatively higher hazard. Fires involving lithium-ion batteries are difficult to put out. | Flow batteries are non-flammable and have no explosion risk. Energy is stored separately from the conversion device, and they can therefore be installed everywhere. |

Lithium batteries decay over time and lose capacity. If cycled every day may last up to eight years. | Absence of degrading material and therefore a longer life span. Vanadium flow batteries can last up to 30 years. |

Currently, the price per kilowatt hour for flow batteries is higher than for lithium-ion batteries. But costs are set to fall significantly over time as production volumes increase. Flow batteries’ adoption is in its infancy with potential for economies of scale. Even today, though, the cost of ownership can be up to 40% less than lithium-ion batteries considering that flow batteries can offer a 25-year life, have a capital expense cost similar to lithium-ion batteries but much lower operating expenses.

Risk considerations

Flow batteries outscore lithium-ion batteries from a risk perspective, due to the fact that they are non-flammable and are considered to have low explosion risk. However, the technology is less tested, and continues to evolve. This is an aspect that may create some discomfort to underwriters.

Battery safety is profoundly determined by the battery chemistry, its operating environment, and the abuse tolerance. While flow batteries are less of a fire risk than lithium-ion batteries, they do release some harmful gases that can be highly explosive or represent an environmental risk. From a risk engineering perspective, the main challenge is the potential build-up of hydrogen during battery operation. Adequate ventilation should therefore be included in any safety considerations. The potential leakage of electrolytes could also create an environmental risk, and is another point that may need to be considered.

Insurers will want to carefully assess every project individually before deciding if it represents a risk they feel comfortable underwriting. As such, it is advisable to engage with insurers at an early stage of any project to discuss potential concerns and address them prior to discussing insurance solutions.

For further information, please visit the Lockton Energy and Power (opens a new window) page, or contact:

Michael Bogdan, Partner Global Energy