Historically, the focus on shareholder return has been the primary objective of company directors. However, the emergence of environmental, social and corporate governance (ESG) risks is forcing directors to give equal consideration to the impact a corporation has on society and the environment.

Investors, shareholders and society are pushing companies to consider the impacts a corporation has on the people and the planet.

Failing to seriously consider ESG issues can cause significant damage to businesses since:

Shareholder activism related to ESG issues is on the rise.

The impact of ESG is increasingly driving investor decision-making.

New avenues for litigation risks are opening up.

The litigation risk

Climate change related litigation against companies and their directors & officers (D&Os) has been on the rise for some time, especially in the energy and financial sectors. More recently, a flurry of diversity related lawsuits (opens a new window) have been filed in the US against major technology firms.

Litigation may impact a company’s reputation and requires significant resources to defend, even if the plaintiffs do not prevail in the end.

Regulatory action

Regulators are also increasing the pressure. To improve transparency regarding integration of ESG factors into investment decisions, the EU’s Sustainable Finance Disclosure Regulation (SFDR) imposes mandatory ESG disclosure obligations for asset managers, private banks and other financial markets participants. The EU is currently working on a legislative proposal for mandatory human rights and environmental supply chain due diligence legislation which is expected to be published in Spring 2021.

Meanwhile the chair of the UK’s Environment Agency called for fines for waste crimes to be linked to the target company’s turnover to create a "strong deterrent". Existing corporate legal obligations, such as reporting obligations or the duty of care, may oblige companies to adequately disclose climate risks and to take them into account when taking important business decisions.

Risks for directors

Failure to seriously consider ESG issues could lead to directors misrepresenting the risks associated with ESGs, leaving the company unprepared when an event happens and amplifying the financial and reputational impacts on the company.

There is growing evidence that companies are at greater financial risk if they are not actively managing their performance related to ESG issues. However, as directors identify ESG challenges, implement ESG strategies and disclose the actions, they need to accept accountability for them. If not, they could find themselves on the wrong end of a breach of fiduciary duty suit. With increased personal accountability, changing attitudes and the rise of social media, directors are increasingly exposed to claims related to employment-related risks, ethics and culture.

ESG compliance responsibility

D&O is a boardroom issue and to tackle ESG risks requires an elevated level of partnership between customers and insurers.

Insurers will increasingly expect directors to be accountable for their actions and that they will manage these topics with internal risk management and full disclosure.

Directors will need to look beyond the usual 2 to 5 year horizon and anticipate future scenarios.

Binding obligations for companies to reduce or limit greenhouse gas emissions are becoming more important.

The board of directors needs to oversee the strategy and risk management of the company and push for measures that ensure a solid and climate-related reporting/transparency and due diligence.

ESG driven claims have already had a significant impact on the directors’ and officers’ (D&O) liability insurance market in 2020 and this trend is likely to continue.

Major ESG claims drivers:

So-called ‘event-driven litigation’ is caused by triggers such as inaction on diversity, poor sustainability performance, or for underestimating or misrepresenting Covid-19 related risks.

Claims stemming from ‘bad news’ events are often initiated by perceived poor governance standards, exploitation in the supply chain, or corporate failure to address climate change with suitable strategies.

Climate change is a growing driver of ESG claims due to increasing scrutiny and activism

This is buoyed by disruption caused by catastrophes, such as: water management issues; biodiversity degradation; exploitation in the supply chain; and corporate governance issues.

Striking the right balance

Aligning the company with this shift in the social and legislative landscape (opens a new window) will help the business avoid fines and expensive lawsuits, reduce reputational risk and enhance its profile if the company demonstrates strong ESG credentials.

Companies that get the balance right will be better positioned to overcome any potential crises. If corporations spend time understanding the risks associated with things like meaningful oversight and disclosure practices, they will likely be in a better position to future proof against regulatory changes that may already be in the works.

Directors should also beware of dismissing ESG liability risks because they can, in a worst case scenario, put at risk a company’s viability. Directors clearly face a new challenge as they need to integrate ESG risks in their decision-making process and operations. Ideally, financial and ESG risks will be seen as two sides of the same coin to be managed and monitored effectively and perhaps even create new business opportunities.

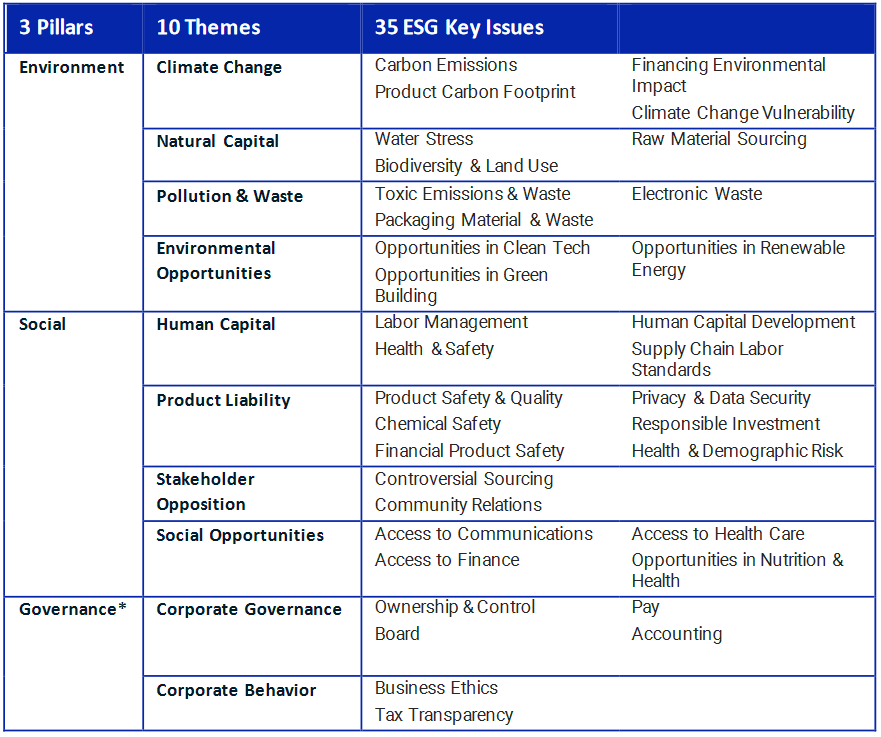

There are several tools that can help to get this right. The MSCI’s hierarchy of key ESG issues can, for example, serve as a checklist for businesses to identify and mitigate a company’s risk exposure:

Source: MSCI ESG Ratings Methodology November 2020

Managing ESG risks

In order to manage these risks, companies need to integrate ESG policies into their business practices and improve their ESG ratings (opens a new window).

To protect and enhance a business’ reputation with multiple stakeholders across such a wide range of issues, businesses must be alert to the shifting emphasis towards ESGs and identify those that resonate most strongly with their primary stakeholders.

ESG factors that are material or may become relevant can shift fairly quickly. Applications using artificial intelligence (AI) can help scan the digital environment for trends in the ESG field and support decision-making and a swift adjustment to policies and practices. The social media temperature of a company is an increasingly important factor that D&O underwriters examine to gauge reputational views.

Companies need to create a framework to identify events or circumstances that are relevant to organizational objectives and assess them in terms of likelihood, magnitude, and impact, to determine a response and monitoring strategy. The worst risks are those that haven’t been foreseen and hit the company and its board unprepared.

Recommendations:

Create a sense of purpose in the company to see the value of integrating ESG into the business.

Identify, prioritise and validate the most material ESG issues that the company should focus on so as to optimise the use of resources.

Strengthen the board/senior executives’ foresight, proactive management and ongoing dialogue on ESG topics.

Adopt a systematic approach to identify, assess and respond to ESG-related risks in business operations.

Develop an ESG strategy that is guided by an overarching vision and mission of the company, and incorporate ESG into strategic planning.

Determine key performance indicators (KPIs) and targets to measure and evaluate ESG performance, with an aim to improve it.

Disclose the company’s ESG vision, strategy and performance in different communications channels.

Train staff to embed the strategy in the corporate culture and identify red flags.

Engage a third party to perform independent assurance on ESG reports or ESG data, giving confidence to stakeholders on the credibility of the report.

Corporate culture

Appropriate company culture is a strong defence risk-mechanism. Studies show that board diversity helps reduce and foresee risk (opens a new window). A multitude of corporate scandals has revealed a common thread in that, at the time of their failures, each company’s board lacked diversity and was unable or unwilling to fully understand the extent of their non-financial ESG issues, risks and opportunities. Regulators are keen to investigate and punish individual officers rather than the entity, forcing directors into increased personal scrutiny to provide assurance that they did everything possible to prevent such cases from occurring.

Directors may face prosecution or civil litigation where they fail in their duty of care to employees or where they preside over a toxic corporate culture that permits abuses. This is particularly true for the US, where allegations of sexual misconduct, bullying and discrimination have led to a spike in the number of employment practices liability claims. A number of derivative class actions have also been filed against boards of corporations that have allegedly turned a blind eye to misconduct or inappropriate workplace relationships.

ESG factors continue to climb the corporate agenda and show little sign of slowing down. Boards need to acknowledge, and critically, actively integrate ESG into their long-term business strategies to safeguard their reputation, protect from costly claims, and to crystallise board values and company culture around modern issues. This is another factor that D&O insurers are increasingly scrutinising, in addition to the usual financial resilience and performance elements of the underwriting process.